Medical equipment and devices are becoming another Polish export hit. Maybe not yet on such a scale as food or furniture, but there is a very strong upward trend. Manufacturers of medical equipment and devices are not only expanding in Europe, according to InfoCredit. They also compete strongly on the most attractive global markets. Not only in Germany, but also in the US and China.

According to the State Investment and Trade Agency, the estimated value of the market for medical devices manufacturers in Poland is already around USD 2.9 billion. The export of medical devices in 2018 increased by as much as 18.9 percent. compared to the previous year and reached EUR 2.2 billion, with the average for all exports at +7 percent. Exports of medical devices already account for about 1 percent. total Polish export of goods.

The upward trend is confirmed by InfoCredit data. Exports of medical equipment from Poland increased from USD 1.03 billion in 2016 to USD 2.42 billion, i.e. by almost 134 percent. Data for 2019 will be coming soon.

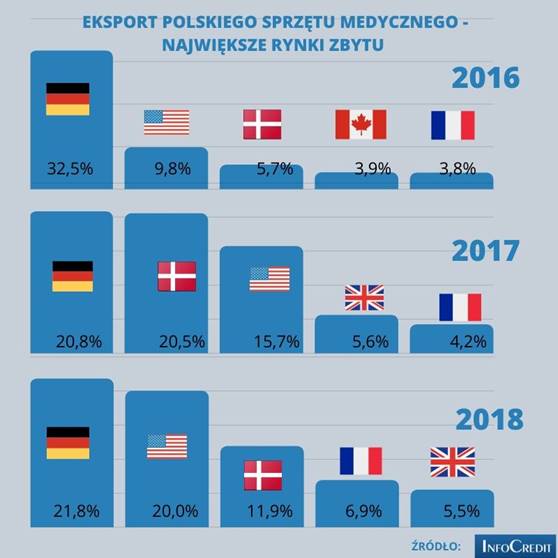

The increase in Polish exports is the effect of the growing foreign expansion of Polish companies in search of sales markets. InfoCredit data shows that the most important recipient of medical equipment from Poland is Germany (currently almost 22 percent). The United States is right behind our neighbor and the largest trading partner. This means that medical devices manufactured in Poland already have an established position on this market. The USA's share in the Polish export of medical devices has been steadily increasing in recent years. Of course, foreign concerns investing in our country can have a significant share in this. However, the production goes to our account.

The five largest markets and their share in the export of Polish medical equipment:

|

2016 |

2017 |

2018 |

|||

|

Germany |

32,5% |

Germany |

20,8% |

Germany |

21,8% |

|

USA |

9,8% |

Denmark |

20,5% |

USA |

20,0% |

|

Denmark |

5,7% |

USA |

15,7% |

Denmark |

11,9% |

|

Canada |

3,9% |

UK |

5,6% |

France |

6,9% |

|

France |

3,8% |

France |

4,2% |

UK |

5,5% |

Source: InfoCredit

The share of non-European markets in the structure of Polish medical equipment exports may still be increasing. This is confirmed by information from Polish companies concluding subsequent contracts. In May last year, Famed Żywiec reported that the Chinese market generates almost 20 percent. annual export sales revenues of the group. According to Famed estimates, by the end of this decade, the Chinese medical devices market will be the second largest in the world. The company said that its asset is quality. Famed equipment is positioned in China in the premium segment and competes with products of American, German or Japanese companies. More information here:https://www.politykazdrowotna.com/44886,polski-sprzet-medyczny-podbija-chinski-rynek

Chinese recipients of medical equipment manufactured in Poland are not yet in the top of this ranking, i.e. in the top five. From year to year, however, climb higher and higher. InfoCredit data shows that in 2016 China was 11th among consumers (2%), and is now 8th (2.3%).

Chinese recipients of medical equipment manufactured in Poland are not yet in the top of this ranking, i.e. in the top five. From year to year, however, climb higher and higher. InfoCredit data shows that in 2016 China was 11th among consumers (2%), and is now 8th (2.3%).

An upward trend is also seen in the results of Polish medical equipment manufacturers who focus on the export and promotion of their products among foreign recipients. InfoCredit has examined the group of exhibitors at the Salmed fair organized in Poznań by the MTP Group. We took into account the revenues of 108 exhibitors who published their results from 2014 to 2018. The group's revenues during this time increased by nearly 30 percent. Their net profit by 112 percent.

Data on the export of medical equipment used for InfoCredit analysis come from the UN Comtrade database. For the purposes of our analysis, we have selected goods from three categories: from instruments and devices used in medicine, surgery, dentistry or veterinary medicine (including scintigraphic apparatus, other electro-medical apparatus and instruments for examining eyesight) through orthopedic equipment (including crutches, surgical belts and trusses; splints and other devices for fractures; artificial body parts; hearing aids and others, worn or implanted in the body) for x-ray apparatus; X-ray tubes, X-ray generators, high voltage generators, control panels and desks, screens, test or treatment tables. We excluded non-medical X-ray equipment from the analysis.