InfoCredit business index

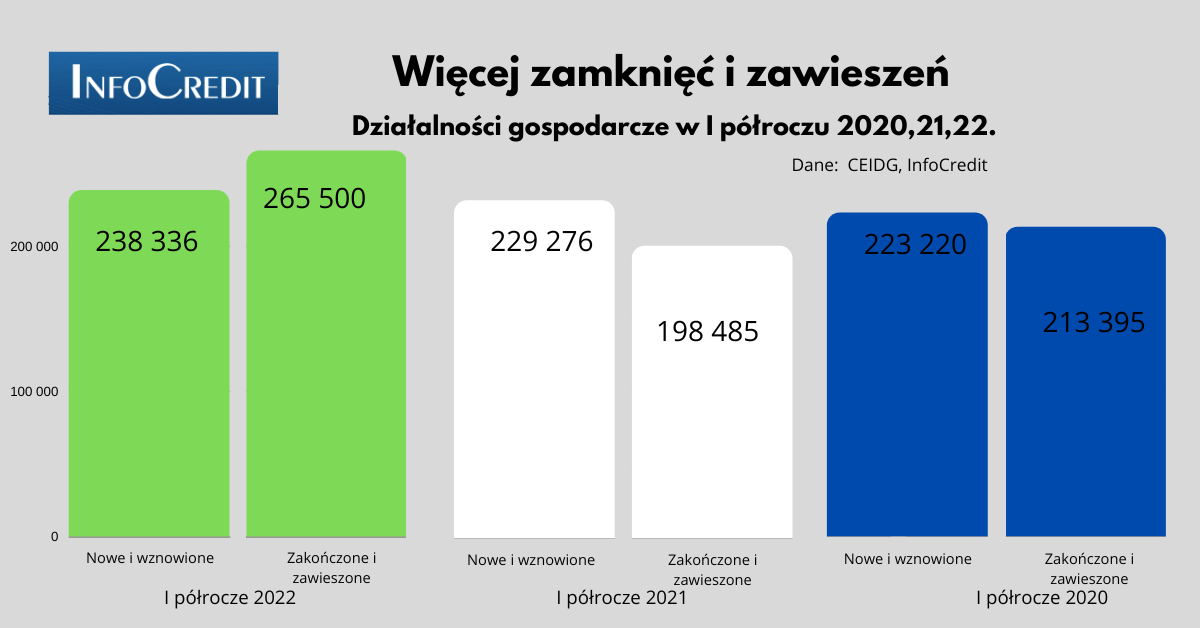

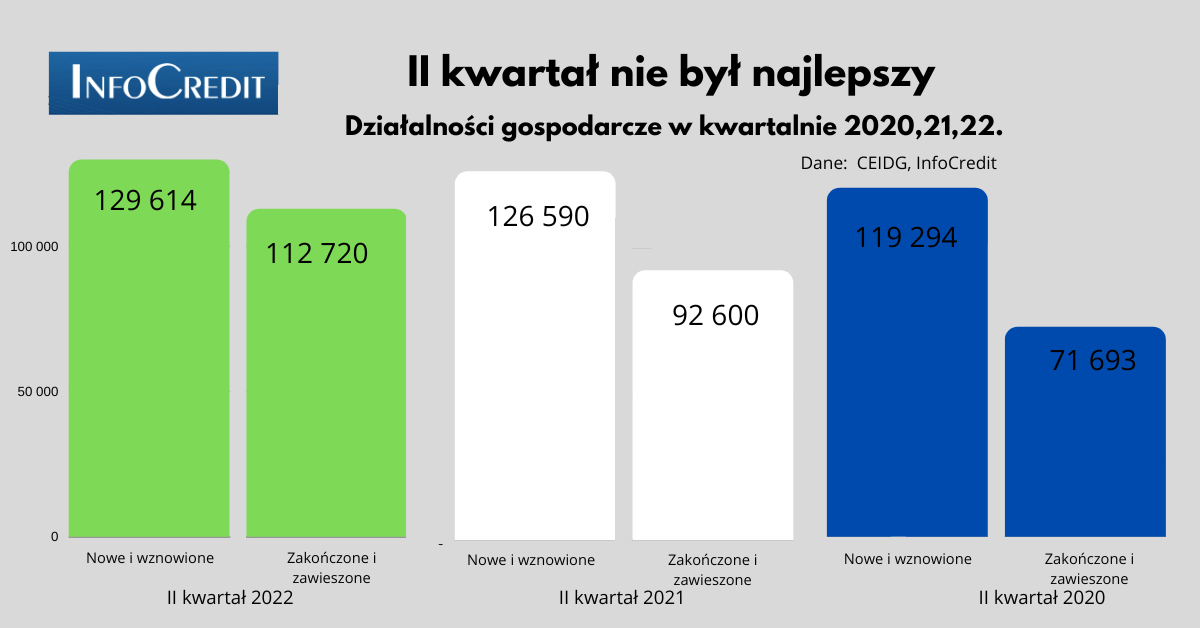

In the first half of 2022, and mainly in the second quarter, entrepreneurs tried to adapt to the new reality. Inflation-tax-war. There were more new and resumed economic activities than in the corresponding periods of 2021 and 2020 The problem is that there were many more suspensions and terminated activities than in the previous two years. On the one hand, the cancellation of the epidemic and the lifting of restrictions have brought new opportunities. On the other hand, an increase in tax burdens and costs has forced many businesses to suspend and close.

Polish entrepreneurs, especially the micro ones, perfectly sense every business opportunity and every problem. We have found out about it since the transformation. They have been building Poland's GDP and economic success since 1989.

- You can't handle the burdens with the current regulations? Back off. Is there a chance? Use it! This is how Polish entrepreneurs have been approaching work for years. In the last three years, with such enormous volatility of the economic situation and business conditions, it is clearly visible. So what if there are more new and resumed economic activities in the second quarter than in the corresponding periods of 2021 and 2020? There are many more suspensions and closures - says Jerzy Wonka, development director of the InfoCredit analytical company.

Let's look at the data. There were 238,336 new and resumed operations in the first half of 2022. This is much more than in 2021 and 2020 (229,276 and 223,220 respectively). Suspensions and Ends? 265,500 in the first half of 2022 against 198,485 in 2021 and 213,395 two years earlier.

Let's look at the data. There were 238,336 new and resumed operations in the first half of 2022. This is much more than in 2021 and 2020 (229,276 and 223,220 respectively). Suspensions and Ends? 265,500 in the first half of 2022 against 198,485 in 2021 and 213,395 two years earlier.

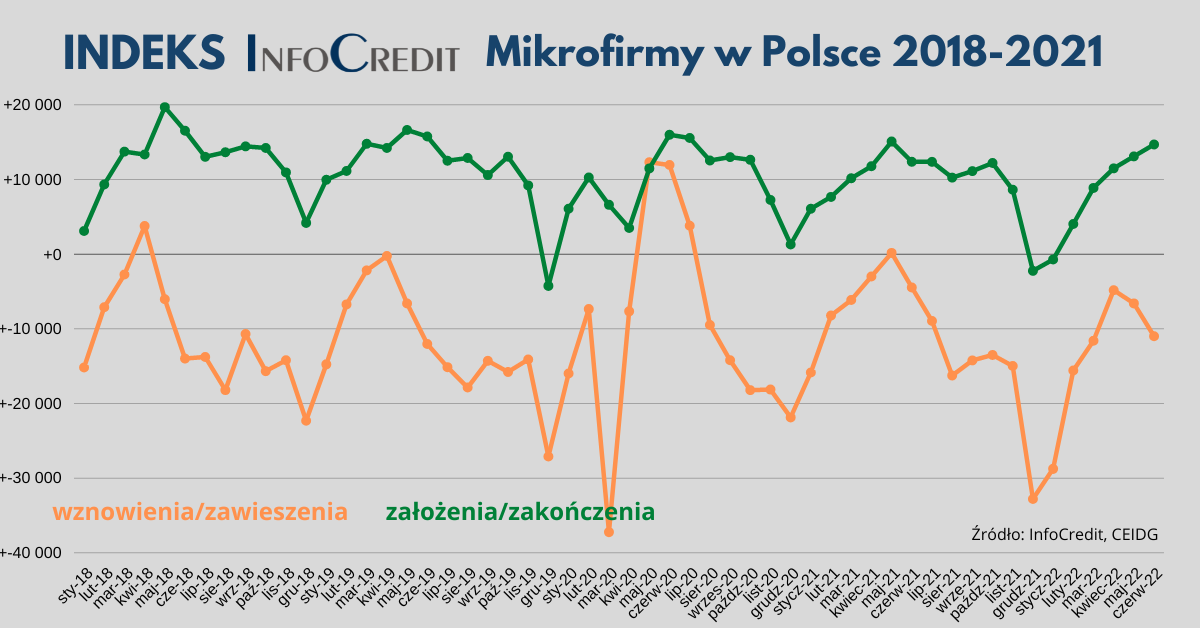

The greatest flight from economic activity was observed at the turn of 2021 and 2022. In January 2022, 26,528 applications for setting up a new business and 8,901 for renewal were recorded. The activity of 37 626 thousand was suspended. entrepreneurs and 27 235 thousand completed No wonder, even then entrepreneurs were afraid of greater tax burdens and confusion related to the Polish Government. Contributions to the Social Insurance Institution (ZUS) also increased significantly - pension contributions from 615.93 to 693.58 PLN, and disability pension contributions from 252.43 to 284.26 PLN (+12.61%).

The greatest flight from economic activity was observed at the turn of 2021 and 2022. In January 2022, 26,528 applications for setting up a new business and 8,901 for renewal were recorded. The activity of 37 626 thousand was suspended. entrepreneurs and 27 235 thousand completed No wonder, even then entrepreneurs were afraid of greater tax burdens and confusion related to the Polish Government. Contributions to the Social Insurance Institution (ZUS) also increased significantly - pension contributions from 615.93 to 693.58 PLN, and disability pension contributions from 252.43 to 284.26 PLN (+12.61%).

- The data strongly tells what is happening in our economy. On the one hand, we are opening and resuming seasonal holiday businesses for the first time in three years without restrictions. On the other hand, it is an escape from rising costs, taxes and unpredictability. The reduction of the PIT tax rate from July 2022 for people settling in the first threshold could have some impact on the opening of seasonal business activities - adds Jerzy Wonka.

Summer business opportunities without the limitations associated with the epidemic caused the Index describing the relationship of new and resumed businesses to rebound sharply. The problem is that the index describing the suspended-to-end relationship dives again. Conclusions? Let's get ready for turbulence in Q3. They will come in September and October, along with rising energy prices and business costs.

- Our last report after the first quarter of 2022 was entitled "Welcome back Szara Strefo". Little has changed after the first half of the year. We are still heading for the gray area. Small business hates a vacuum. It will do its job. I'm afraid we're going back to the time when "cash is the king". The problem is that this does not apply to the zloty. Our currency becomes hot paper. With such high inflation, the money earned in gray, small entrepreneurs will again be a rush - as in the 90s - to exchange them for dollars and francs in order to lose as little as possible. On the other hand, a weak zloty is an opportunity for those who cooperate with foreign entities and receive part or all of their remuneration in euros or dollars - says Jerzy Wonka.

And what is the overall state of economic activity? According to CEIDG data, three years ago there were 2 548 016 active economic activities, including activities conducted only in the form of a civil law partnership, compared to 2 601 617 at the end of the first half of 2022. This means that the number of active small businesses in Poland remains more or less on a constant level. On the other hand, a sharp increase in suspended activities was recorded - from 449,296 after the first half of 2019 to 566,495 after the first half of 2019.

How do we calculate the InfoCredit Index?

The InfoCredit indicator was created to track trends in micro-entrepreneurship, alternative forms of employment and self-employment at a time when the situation on the labor market and individual industries is changing dynamically. The index, which is compiled by the oldest economic analysis company in Poland, takes a positive value when there are more new activities than closings. When there is less than finished - negative. In the same way, we also track the relationship of resumes to suspended activities.

#statystyki #gospodarka #praca #RynekPracy #IndeksInfoCredit #mikroprzedsiębiorczość #koniunktura #mikrofirmy #mikroprzedsiębiorcy