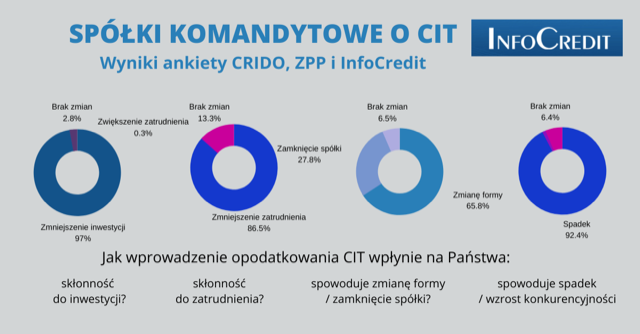

- 97% of the surveyed entrepreneurs-co-owners of limited partnerships believe that CIT will reduce their willingness to invest.

- 86.5% say that CIT will reduce the willingness to work.

- 94.5% believe that the new tax will reduce the competitiveness of limited partnerships.

- 65.75% consider changing the form of business as a result of legal changes, and 27.75% closing the business.

- results from a survey conducted in October by InfoCredit in cooperation with CRIDO and the Association of Entrepreneurs and Employers (ZPP).

Entrepreneurs and co-owners of limited partnerships unequivocally assessed the impact of introducing CIT on the future of their businesses. The survey results confirm the conclusions of the CRIDO, ZPP and InfoCredit reports "SPK in Poland - data analysis" and "Taxation of limited partnerships in Europe" presented in October.

- Polish small family companies are the most concerned about the changes. They definitely prevailed in the survey, they answered most willingly and quickly. Over 87% of the completed questionnaires came from companies employing up to 49 people - says Jerzy Wonka, InfoCredit Development Director.

The vast majority of the respondents, as much as 97%, believe that the tax will lower their willingness to invest. Only 2.75% say they will have no influence and 0.25% say investments will increase. 86.5% say that CIT will reduce the willingness to work (0.25% increase, 13.25% no impact). 94.5% believe that after the introduction of double taxation, the competitiveness of their companies will decrease (competitiveness increase by 1.25%, with no impact of 4.25%).

Entrepreneurs believe that continuing to run their business in the form of a limited partnership after the introduction of CIT is no longer relevant. As many as 65.75% are considering changing the form of business activity, and 27.75% are considering closing the company. Only 6.5% answered that CIT would not change anything.

- Contrary to the declarations of the Ministry of Finance, the results of the survey showed what had already emerged from the reports prepared by us. The overwhelming majority of entrepreneurs, especially small ones, decidedly negatively assessed the idea of taxing CIT limited partnerships. It remains to be hoped that the Senate will hear the voice of Polish entrepreneurs and the organizations representing them and, consequently, such bad regulations will not be passed. The more so because it happens at a time of a creeping lockdown and many other problems that companies have to face. In such circumstances, discouraging entrepreneurs from fighting for their businesses is very harmful to the economy - comments Mateusz Stańczyk, partner in the tax advisory team at CRIDO.

- The results of the survey confirm our assumptions - CIT taxation of limited partnerships is a powerful blow to investments and employment. Moreover, it coincides with the crisis caused by the coronavirus epidemic, during which the propensity of entrepreneurs to invest has dropped to a record low level anyway. It is difficult to understand the legislator's determination to push for this solution. It will not lead to the reduction of tax fraud, because limited partnerships are not the problem in this respect - we have not only shown it in the reports published so far, but also the Ministry of Finance itself admitted it. According to the information provided by the ministry, the tax authorities only challenged tax schemes using limited partnerships six times. One of the effects of this bad regulation may be the difficulty in overcoming the crisis caused by COVID-19 and the practical elimination of limited partnerships from the Polish economic landscape - claims Jakub Bińkowski, director of the Department of Law and Legislation of the Union of Entrepreneurs and Employers.

__________________________________________________________________________________________________________________

About the survey

#podatki #CIT #prawo #biznes #spolkikomandytowe #przedsiebiorczosc #podwojneopodatkowanie #MSP