The acquisition of CIT limited partnerships will increase the burden on tens of thousands of Polish entrepreneurs

- The application of CIT to limited partnerships will lead to a significant increase in taxes for nearly 73,000 Polish entrepreneurs.

- The most thriving businesses will suffer the most, as they will not have a chance to benefit from the lower 9% CIT rate, and the actual taxation of the shareholders of these companies will increase to 34% -38% instead of the current 19% -23%.

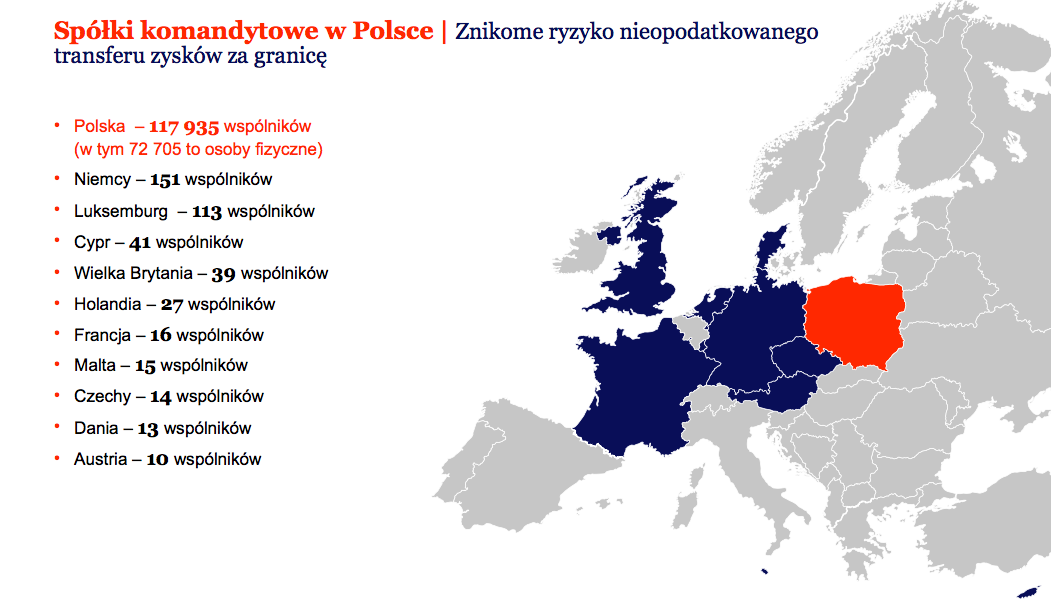

- Only 1% of limited partnerships have foreign partners, and their share in the total number of partners of limited partnerships is 0.4%, which means that the possible risk of a tax-free transfer of profits abroad is marginal

– results from a report presented at a joint conference of CRIDO, ZPP and InfoCredit.

Consequences for business

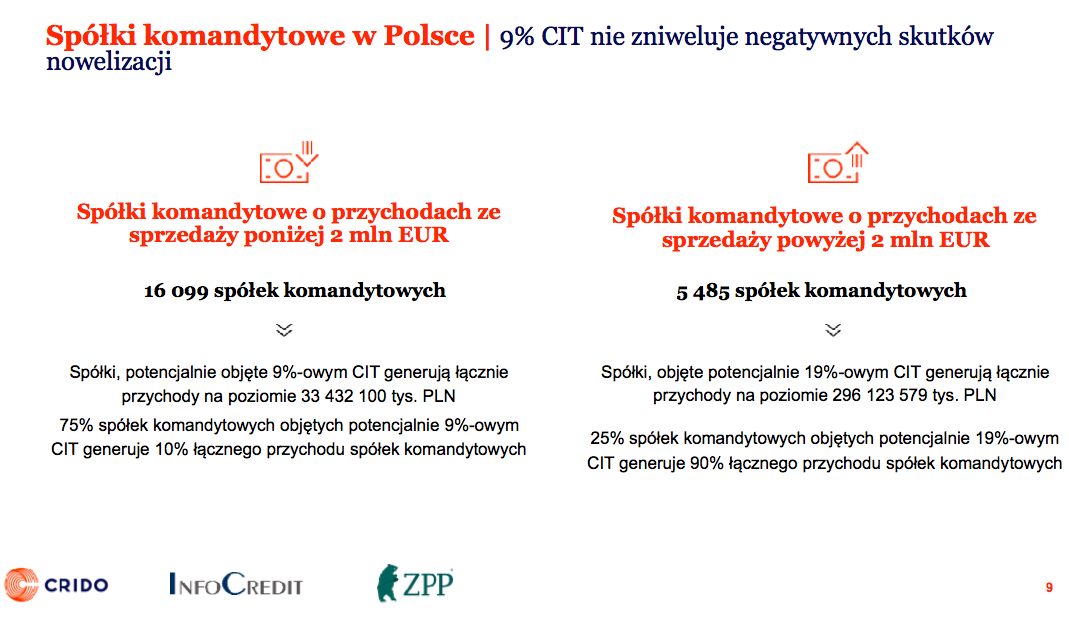

Due to the planned tax changes (as of October 2, 2020), there will be a significant increase in the tax rate for nearly 73,000 Polish entrepreneurs. About 75% of companies with lower turnover will be able to benefit from the 9% CIT rate instead of the 19%. However, as many as 25% of limited partnerships responsible for 90% of the revenues generated by these businesses (i.e. nearly PLN 300 billion annually!) Will pay 19% CIT. Effectively, the interest rate of the partners of these companies, mainly Polish entrepreneurs, will increase to 34% or, in the case of people paying the solidarity levy, to 38%.

Even the Estonian CIT will not help

A new tax benefit in the form of the so-called Estonian CIT does not include limited partnerships. Even assuming that some entrepreneurs will decide to transform into a capital company (LLC or SA), they will probably also remain, apart from this preferential tax regime - this form of activity is popular, in particular, among entrepreneurs operating in the trade and service industry, which means no capital expenditure which is a condition for using this form of taxation.

Limited partnerships are not widely used for international tax optimization

Contrary to the rationale for the proposed changes, the data do not indicate that limited partnerships are used in international tax optimization schemes. In Poland, about 43,000 limited partnerships conduct active business activity. According to the analysis of CRIDO experts, based on data from the InfoCredit database, 92% of limited partnerships are businesses of natural persons from Poland. 72 705 thousand Poles run their businesses in this form.

For comparison, only 0.4% of partners in limited partnerships in Poland come from abroad. The first place is taken by Germany (151 partners) for whom this form of business activity is quite common and which is indicated as one of the reasons for Germany's economic success. It is followed by Luxembourg (113 partners), Cyprus (41) and the United Kingdom (39).

We are talking about the whole country and many industries

Limited partnerships are scattered all over the country. Most of them are in the following voivodships: Mazowieckie (11,290), Wielkopolskie (5611), Małopolskie (4744) and Śląskie (3792). They operate in various sectors, most of them are involved in industrial processing, construction and trade. Many transport, logistics and catering companies operate in this way. This form allowed for the development of many Polish entrepreneurs who, having a "flair" for business and running it, could at the same time reduce the risk for their family.

- The combination of single taxation of 19% with reducing the risk of running a family business is a positive stimulus and motivator for the development of entrepreneurship. This is shown, for example, by the example of Germany, whose economic power grew out of family businesses run in the form of limited partnerships. The planned double taxation of limited partnerships will not only be a negative signal for Polish entrepreneurs, but will also put domestic companies in a worse market position in relation to their foreign competitors. Taking into account the EU directive, the so-called Parent-Subsidiary, a foreign investor from the EU, will pay no more than 19% of income tax - comments Mateusz Stańczyk, partner at CRIDO.

- Covering limited partnerships with CIT is a bad idea. It does not appear from the data that these were entities used for international optimization schemes. However, they are an attractive form of business for Polish, dynamically developing business. It should be emphasized that this is another proposal to increase the levy burden, which appeared in a relatively short time. Meanwhile, according to our research, the tendency of entrepreneurs to invest is the lowest in years - it is not happening without reason. Repeated changes in regulations, the sudden introduction of new burdens, the lack of elementary legal security for companies are the main reasons why the investment rate in Poland is far from the 25% GDP expected by the Strategy for Responsible Development - claims Jakub Bińkowski, director of the Union's Law and Legislation Department Entrepreneurs and Employers.

- Today, as never before, any proposed change to the tax system should also be analyzed in the context of employment. Greater burdens for tens of thousands of Polish entrepreneurs may mean less willingness to create new jobs or keep the existing ones. InfoCredit will soon conduct a survey among entrepreneurs so that they can assess the proposed changes in taxation in the context of employment and their market opportunities. We will share the results of this survey with you in October. The InfoCredit index has been signaling for many months that at a time when the number of jobs is decreasing, the number of sole proprietorships is increasing. And these have much less ability to achieve market success than companies with an established position - says Jerzy Wonka, InfoCredit development director.

#podatki #CIT #prawo #biznes #spolkikomandytowe #przedsiebiorczosc #podwojneopodatkowanie #MSP