Recent years have been very successful for the industry of building materials manufacturers and traders. This can be seen at the exhibitions and attendance at this year's BUDMA. Behind the scenes, however, there is talk of the risk of a slowdown in the industry. This is the effect of recent CSO data and global factors. Expansion into new markets can help.

50,000 professionals, investors, engineers and architects, almost 1,000 exhibitors from over 30 countries around the world - this is what BUDMA 2020 looks like. The real value can be seen not only in the exhibition, but above all in numbers. The revenues of exhibitors, from 2012 to 2018, increased by two-thirds. They are ahead of the competition not only in terms of sales dynamics, but also profitability - according to data from the analytical company InfoCredit.

Manufacturers of building materials regularly presenting at BUDMA have increased their revenues by over 67 percent in the last 6 years. Revenues of comparable companies in the industry increased by 50.4 percent during this time.

Companies regularly presenting at the fair are taking great advantage of the opportunity to attract new customers, also abroad. It accelerates the development of companies and drives profits. Nearly 91 percent of this year's exhibitors companies have positive net profitability. Only 9 percent of them ended in 2018 with a loss. For comparable companies across the industry, these ratios are 84.4 percent, respectively. and 15.6 percent.

However, the 2018 results of companies are history. You have to wait until spring for those from 2019. Today, entrepreneurs look at the latest macroeconomic data, and these are no longer the best. And look out for more.

Construction and assembly production in Poland in December 2019 was 3.3 percent lower counting year to year. In the period of January-December 2019, construction and assembly production increased by 2.6%. In the corresponding period of 2018, an increase of 17.9 percent was recorded. No wonder that entrepreneurs are slowly becoming more and more cautious. In December 2019, the business climate indicator in construction calculated by the Central Statistical Office was minus 4.6 (a year earlier it was -2.8). It was the second month after November with a negative indicator. Last year the best economic situation was assessed in April (+8.9). Since then, this indicator has been falling.

These data affect the moods of producers and distributors of building materials presented in Poznań. An opportunity for them can be expansion and the search for new markets. BUDMA is the perfect place to attract new contractors. The more so that the demand for Polish building materials abroad has increased in recent years.

These data affect the moods of producers and distributors of building materials presented in Poznań. An opportunity for them can be expansion and the search for new markets. BUDMA is the perfect place to attract new contractors. The more so that the demand for Polish building materials abroad has increased in recent years.

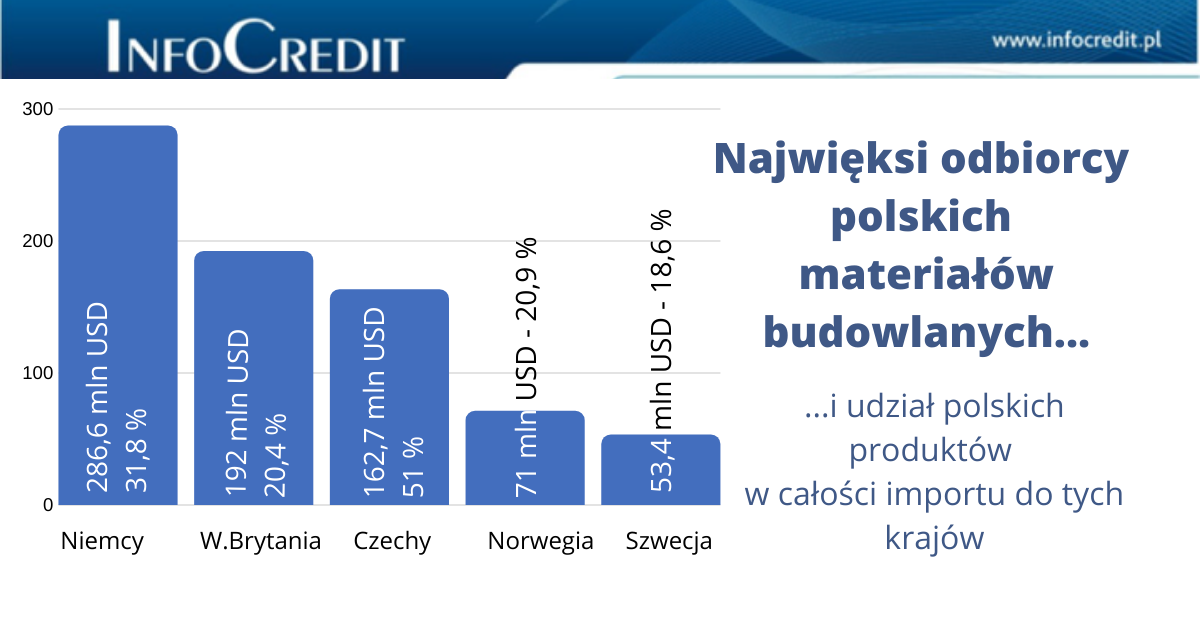

In 2018, Poland recorded an increase in sales to all recipients from the top ten. Exports to Germany increased by over 21%, Great Britain by 6.9%, the Czech Republic (17.1%) Norway and Sweden (8.7 and 26.6% respectively). The highest increase was recorded in the case of France, which occupies 10th place (37.8%).

One of our most important Polish export products are windows and doors. In 2018, our exports were worth almost USD 1.2 billion. According to InfoCredit, Polish companies are the largest supplier of joinery to Germany, Great Britain, the Czech Republic, Sweden, Italy, Slovakia and Belgium. On the Norwegian market, we occupy the 2nd place among suppliers, the Dutch 3rd place. Among the 10 largest recipients only in France we occupy a place outside the podium, i.e. 6.

As you can see Polish manufacturers of building materials have already had major markets in Europe and neighboring countries. They already have a leading position on many of them. What's next? There are still many markets left with reserves. The US imports building materials for USD 2.3 billion a year, of which only 0.8% Poland is responsible for this amount. Canada for almost USD 415 million a year (imports from Poland are only 0.75 of this amount). Far? Switzerland, which imports for nearly USD 600 million per year, and Austria (for over USD 340 million) are much closer. Imports from Poland do not exceed 5 percent these amounts. So there are reserves, and BUDMA is to use them.